Finding the right tenant is one of the most important steps in protecting your investment property. A great tenant means fewer headaches, consistent rent payments, and a well-maintained home. So, what do property managers look for when screening applicants? Here are the three big factors:

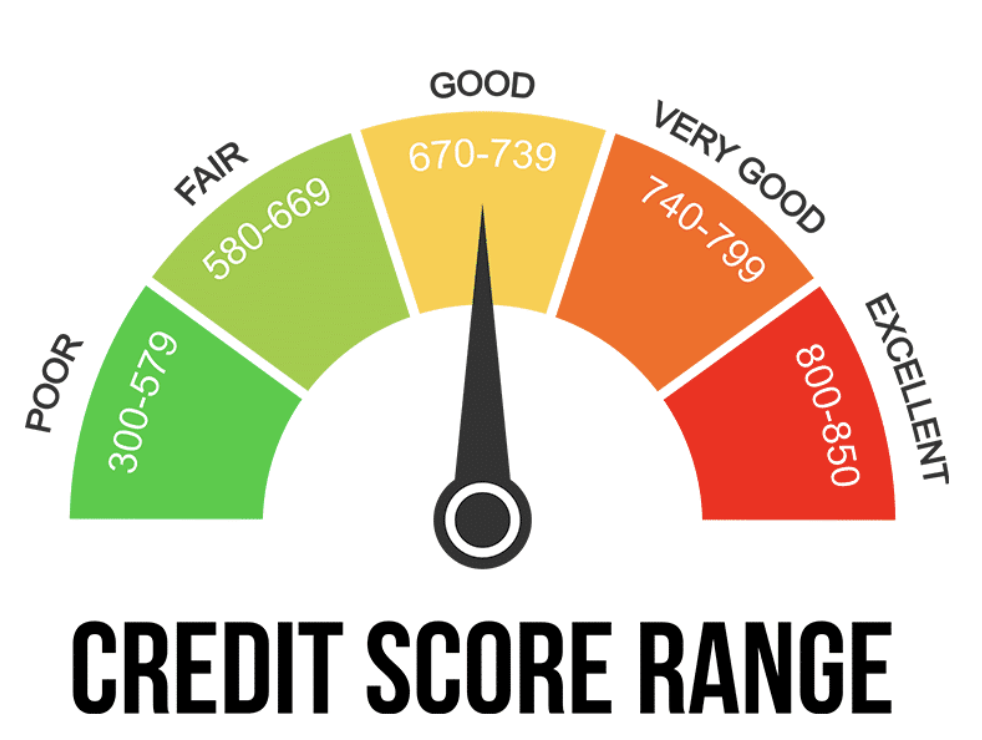

Credit Score

A tenant’s credit score gives you insight into their financial responsibility. While the exact number may vary by property manager, a solid credit score usually indicates that the applicant pays bills on time and manages debt well.

No Recent Evictions

Past behavior often predicts future behavior. Property managers check for eviction history over a certain number of years to ensure the applicant has a track record of honoring lease agreements. A clean history is a strong sign of reliability.

Income: At Least 3x the Rent

To make sure tenants can comfortably afford the property, most managers require that their monthly income is at least three times the rental amount. This helps reduce the risk of late payments and financial strain.

Screening tenants properly protects your property and your income. By focusing on these three criteria, you can avoid costly turnovers, late payments, and unnecessary stress.